Buildings Valuation for Village Halls

Building valuation for Village Halls - comprehensive 10-14 page report

Buildings Valuation for Village HallsVillageGuard Village Hall Insurance – Protecting Halls and Trustees

Underinsurance: A Growing Risk for Village Halls & Trustees

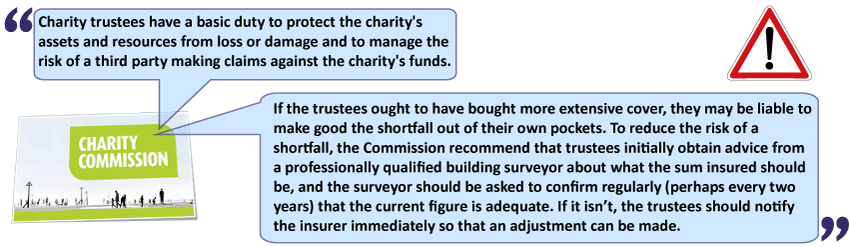

Underinsurance poses a significant risk to village halls and their trustees across the UK. Recent surveys reveal that many halls are undervalued and underinsured, putting both the facilities and the trustees in a precarious situation. At Allied Westminster, we are committed to raising awareness about this issue and providing a viable solution.

Understanding the Consequences of Underinsurance

Underinsurance can have serious repercussions for village halls and trustees, as it may result in insufficient coverage in the event of a claim. The resulting financial burden can strain hall resources and place trustees at risk. Allied Westminster recognises the importance of addressing this problem and offers an innovative solution.

Affordable Valuation Reports for Accurate Insurance

The most straightforward solution is to have the hall professionally valued. However, the cost of a full on-site survey by a RICS Surveyor, ranging from £700 to over £1,000, is often unaffordable for many hall committees. Moreover, the Charity Commission recommends regular revaluations.

That's why Allied Westminster introduces a cost-effective alternative:

- A comprehensive Valuation Report that details all property assets of a hall, including the main building, outbuildings, car parks, tennis courts, fences, and more, alongside 'rebuild times'.

- Trustees can calculate potential loss of earnings from hall closure and set an accurate sum insured.

This report is available for just £75 for VillageGuard® clients and at a subsidised rate for other halls, even those not insured with us.

Our Mission: Eliminate Under-Insurance Across the UK

We aim to eradicate underinsurance for as many village halls as possible by offering highly cost-effective survey solutions. The potential cost of not having a survey far outweighs the investment in a Valuation Report.

How It Works

Complete and return a simple form (by post or online).

Our expert surveyors analyse the content, along with other accessible information, to create a detailed valuation report without a site visit.

The underwriters of VillageGuard, guarantee to accept the report's results for five years, allowing you to adjust your sum insured based on the report.

Your premium may increase or decrease accordingly, with any decrease resulting in a refund.

All VillageGuard policies, including updated sums insured, are subject to index linking upon renewal.

This process effectively eliminates the risk of potential legal action against trustees due to underinsurance for five years. We recommend revaluations every five years.

Take Action Now

- Existing VillageGuard clients can DOWNLOAD THIS PDF FORM. Save the file before completing, and open in Adobe Acrobat for the best experience.

- New clients will receive full terms and conditions when requesting a VillageGuard quotation. Request a Quote.

For more information, call us on 01937 845245 or complete one of the forms above.

Allied Westminster: Your Trusted Partner in Village Hall Insurance